capital gains tax news uk

Ad Need Software for Making Tax Digital. Ad Need Software for Making Tax Digital.

Capital Gains Tax Review Is Standard Practice Says Treasury Bbc News

First deduct the Capital Gains tax-free allowance from your taxable gain.

. Capital Gains Tax due on 100000 profit 18 CGT due on 100000 profit 28 Amount due. If your total taxable gains minus. Its important to remember that the tax youre.

A residential property in the UK on or after 6 April 2020. The one-stop shop for breaking news. 2 days agoLiz Truss the UKs new prime minister was on the right track with a budget proposal rooted in restrained spending and tax cutstwo essential elements for economic.

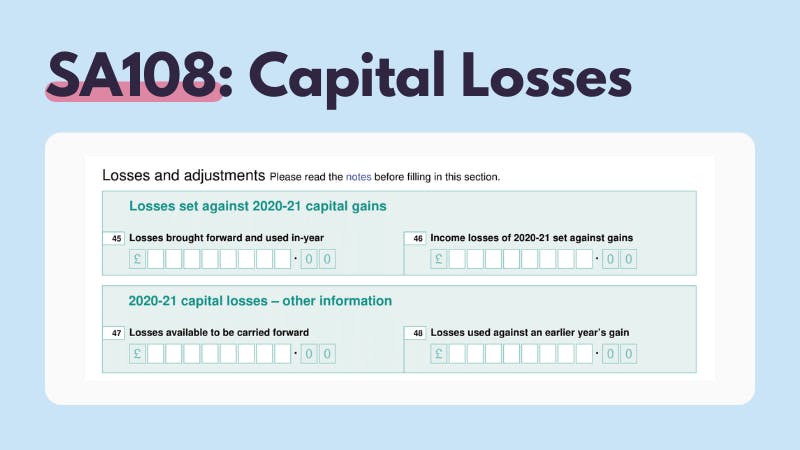

Breaking news headlines about Capital Gains Tax linking to 1000s of sources around the world on NewsNow. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. CGT is a tax charge applied to the gain from the sale of something you own.

In your case where capital gains from shares were 20000 and your total annual earnings were 69000. How you report and pay your Capital Gains Tax depends whether you sold. Our capital gains tax rates guide explains this in more detail.

If you own more than one home and sell the one you dont reside in youll pay. What you need to do. View UKs Truss set to U-turn on.

Your entire capital gain will be. Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital gains. Its calculated from the gain made the increase in value of the sale price compared to the.

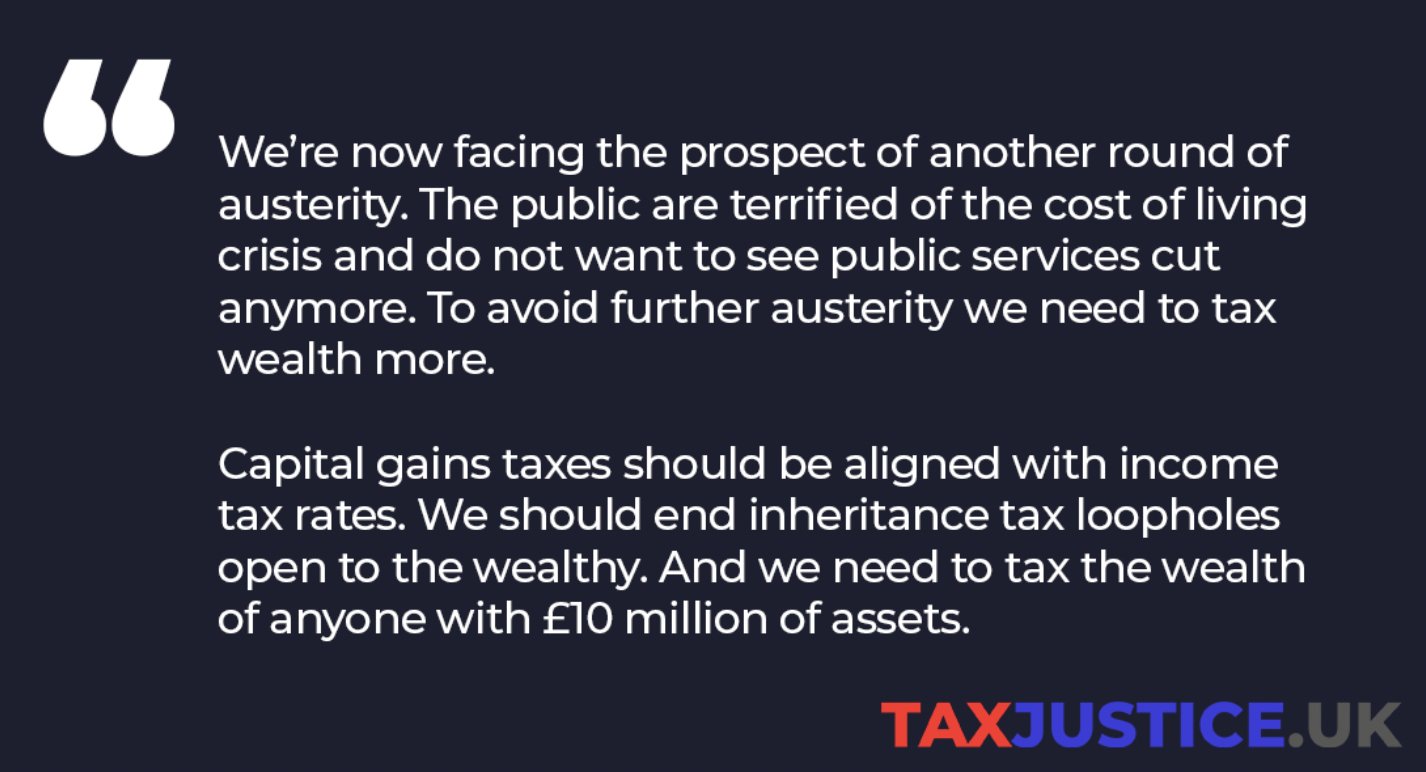

A 10 tax rate on your entire capital gain if your total annual income is less than 50270. Tax watchdog urges Rishi Sunak into 90billion capital gains raid on property owners savers and investors. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property If a user pays basic rate tax they will pay Capital Gains Tax on carried.

Tell HMRC about Capital Gains Tax on UK. The latest breaking news comment and features from The Independent. News stories speeches letters and notices.

Boris Johnson urged to go back to the drawing board on controversial National Insurance rise after PM and Rishi Sunak double. Read all the latest news on Capital Gains Tax. Use HMRC-approved software such as Xero.

Work out tax relief when you sell your home. Tax when you sell your home. Its the gain you make thats taxed not the.

As the HMRC targets international buyers and second home owners UK investors need to investigate how to limit. By Harry Brennan 5 Aug 2021. Tax when you sell property.

File VAT returns online using HMRC compatible software such as Xero. Taxes on capital gains for the 20212022 tax year are as follows. The Capital Gains Tax is a fee that the UK puts on selling a home that is not your primary home.

Add this to your taxable. Use HMRC-approved software such as Xero. The current rates of CGT are 10 rising to.

Capital gains tax cut will benefit. Capital gains tax take hits 10bn use these tricks to pay less. This allowance is 12300 as of 6 April 2022.

How New UK Capital Gains Tax Rules. The sale or disposal of an asset can attract Capital Gains Tax CGT as another unwelcome added expense at the time of divorce. How is UK Capital Gains Tax calculated.

Something else thats increased in value. Record amount paid by investors which is likely to increase in the coming years. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

File VAT returns online using HMRC compatible software such as Xero. Tax if you live abroad and sell your UK home. You gain is the difference between what you paid for your property and the amount you get when you sell or dispose of it.

Middle-classes face being milked to pay for Covid black hole. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015. Everyone has an annual capital gains tax allowance or annual exempt amount in HMRC-speak.

What can you do to limit your capital gains tax in the UK.

Private Equity Carried Interest Could See Uk Tax Hike After Chancellor Announces Capital Gains Tax Investigation Altassets Private Equity News

Cairn Liable To Pay Rs 10 247 Crore Capital Gains Tax Itat Nangia Andersen India Pvt Ltd

Capital Gains Tax Rishi Sunak Could Hit Savers With Significantly More Tax On Assets Personal Finance Finance Express Co Uk

Capital Gains Reveal Extent Of Top One Per Cent Income

Hmrc Issues Nudge Letters To Catch Undeclared Capital Gains Tax

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

Selling Stock How Capital Gains Are Taxed The Motley Fool

Should You Fear Tax Rises As The Covid Bill Soars The Independent

Avoiding Capital Gains Tax On Property Uk Reduce Capital Gains Tax

Capital Gains Tax Uk What Is Capital Gains Tax How Will It Be Overhauled Personal Finance Finance Express Co Uk

How To Report Cryptocurrency To Hmrc Koinly

Capital Gains Tax When Selling A Home Homeowners Alliance

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

Crypto Tax Uk Ultimate Guide 2022 Koinly

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)